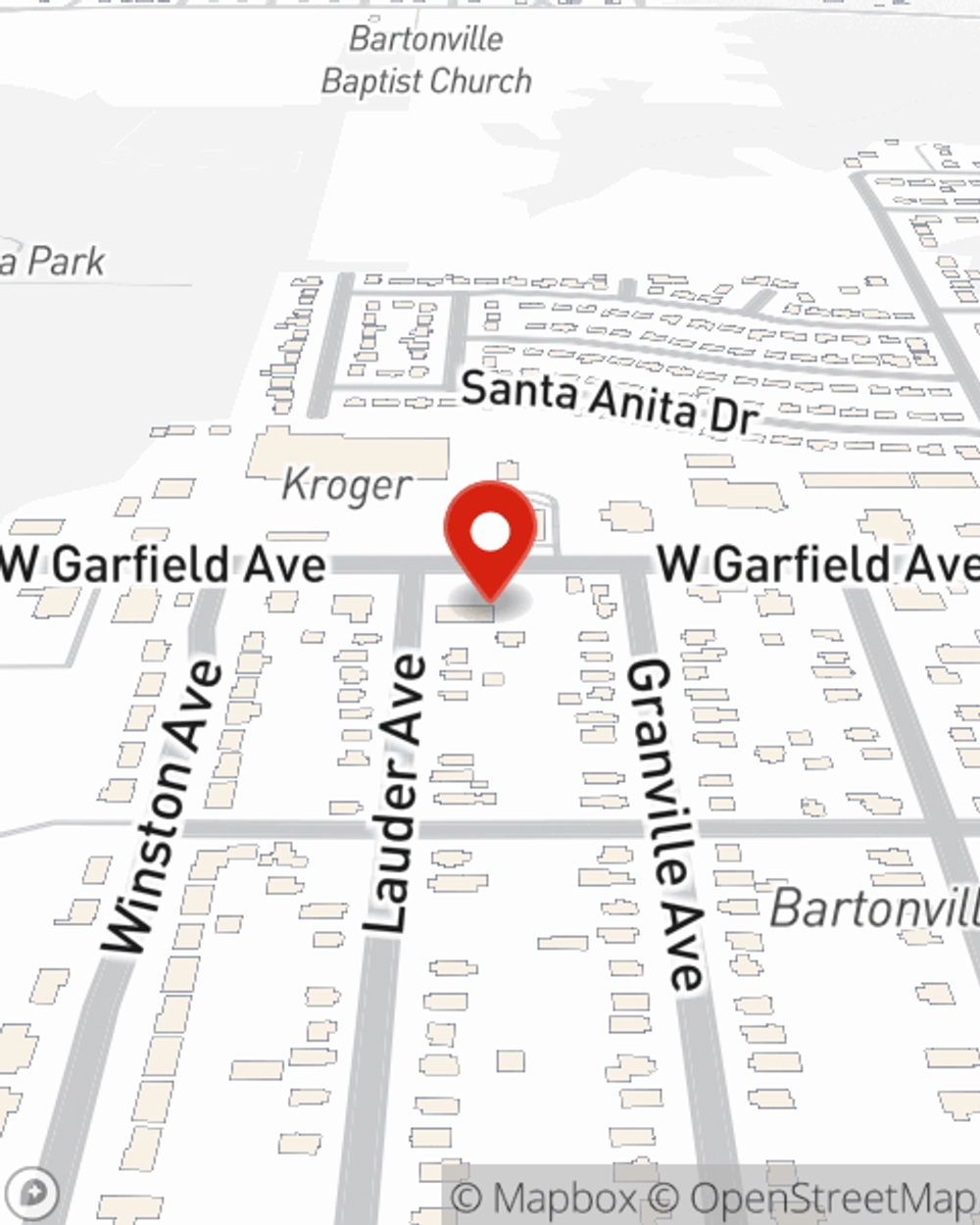

Business Insurance in and around Bartonville

Looking for protection for your business? Look no further than State Farm agent Kelly Cloyd!

Helping insure small businesses since 1935

- Mapleton

- Bellevue

- Glasford

- Peoria

Your Search For Remarkable Small Business Insurance Ends Now.

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

Looking for protection for your business? Look no further than State Farm agent Kelly Cloyd!

Helping insure small businesses since 1935

Insurance Designed For Small Business

When one is as driven about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for business owners policies, commercial auto, surety and fidelity bonds, and more.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Kelly Cloyd's team to review the options specifically available to you!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Kelly Cloyd

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.